The Pros and Cons of Outsourcing Your Accounts Payable

- 26 November 2024

- Posted by: Nexanture

- Category: Finance & Accounting

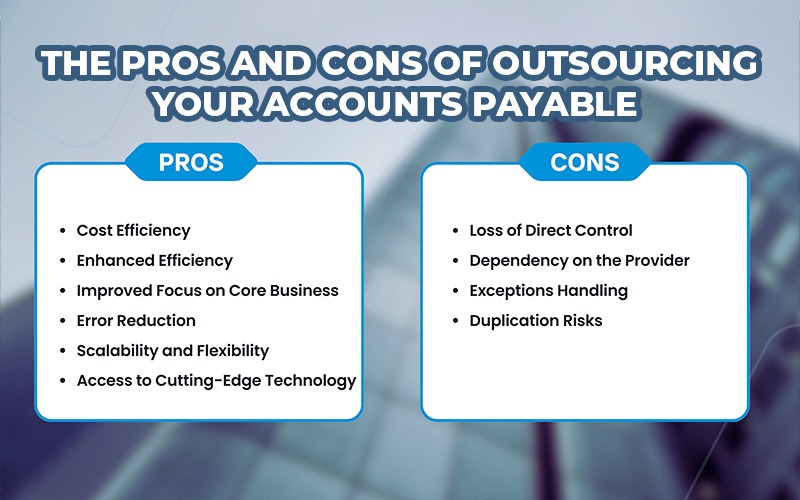

In today’s fast-paced and competitive business environment, companies need innovative strategies to stay ahead. Outsourcing your accounts payable (AP) process has emerged as a powerful solution to boost efficiency, save costs, and drive growth. However, it’s essential to carefully weigh the benefits and challenges before making this strategic move.

While outsourcing AP can streamline operations and free up resources for growth, it also comes with considerations that require careful planning and the right outsourcing partner. Here, we explore the pros and cons to help you make an informed decision.

The Benefits of Outsourcing Accounts Payable

Outsourcing AP isn’t just about shifting responsibilities; it’s about unlocking the full potential of your financial operations. Here are the key advantages:

- Cost Efficiency: Managing an in-house AP team comes with costs related to hiring, training, and maintaining the necessary software and infrastructure. Outsourcing allows you to leverage a team of experts at a fraction of the cost, significantly reducing your overall expenses.

- Enhanced Efficiency: Accounts payable outsourcing providers use advanced technologies like automation and AI, enabling them to process invoices faster and more accurately. This eliminates bottlenecks and ensures that payments are processed on time.

- Improved Focus on Core Business: Outsourcing allows your team to focus on strategic activities rather than routine financial tasks. By removing the AP workload from your in-house team, you free up valuable time for innovation and growth.

- Error Reduction: Human errors in invoice processing can lead to costly mistakes. Outsourcing minimises these errors through automation and expertise, ensuring your financial data is accurate and reliable.

- Scalability and Flexibility: Outsourcing providers can easily scale their services to match your needs during busy periods or as your business grows. This flexibility ensures that your AP processes can adapt without requiring additional in-house resources.

- Access to Cutting-Edge Technology: Outsourcing firms invest in the latest AP technology, providing you with tools for real-time tracking, automated workflows, and comprehensive reporting without the upfront cost.

The Challenges of Outsourcing Accounts Payable

While outsourcing AP offers many advantages, there are potential drawbacks to consider:

- Loss of Direct Control: Outsourcing means delegating a critical financial function to an external provider. While this can be beneficial, it may feel like a loss of control. This challenge can be mitigated by choosing a partner like Nexanture, which ensures transparency, regular communication, and clear reporting.

- Dependency on the Provider: Relying entirely on an outsourcing partner can pose risks if the provider faces issues like financial instability or data breaches. To address this, work with a reputable and financially stable partner like Nexanture Outsourcing Solutions and have contingency plans in place.

- Exceptions Handling: Some outsourcing firms may limit the types of invoice exceptions they process, leaving you to handle certain complexities in-house. Nexanture Outsourcing Solutions ensures that all exceptions are managed seamlessly, offering a comprehensive solution tailored to your business.

- Duplication Risks: Duplicate submissions can lead to unnecessary costs and confusion. By implementing strict submission protocols and leveraging Nexanture’s robust tools for error detection, these issues can be effectively mitigated.

Why Nexanture Outsourcing Solutions Is Your Ideal Partner

At Nexanture, we specialise in delivering tailored accounts payable solutions that address these challenges while maximising the benefits of outsourcing. Our approach combines state-of-the-art technology, a dedicated team of experts, and a commitment to transparency, ensuring your AP processes are efficient, accurate, and secure.

- Tailored Solutions: We work closely with you to define the scope of services, ensuring alignment with your business needs.

- Transparency and Communication: Regular updates and detailed reporting give you full visibility and control over your AP processes.

- Cost Savings: Our solutions are designed to significantly reduce operational costs without compromising quality.

- Seamless Integration: Nexanture’s services integrate seamlessly into your operations, ensuring a smooth transition and ongoing efficiency.

- 10+ Years of AP Outsourcing Expertise: At Nexanture, our specialists bring over a decade of expertise in managing accounts payable outsourcing on a global scale. With a proven track record of delivering efficiency, accuracy, and cost savings, we understand the complexities of AP processes across industries and geographies.

Transform your accounts payable process with Nexanture Outsourcing Solutions. By partnering with us, you’ll streamline operations, reduce costs, and free up your team to focus on what really matters.

Contact us today to learn how we can support your AP needs and drive your business forward with confidence. Together, we’ll create a solution tailored to your success.

Contact Nexanture Outsourcing Solutions today to learn how we can help your business achieve its financial objectives and help you lead the future.

How Can We Help You?

We’re delighted to connect with you! Your thoughts, queries, and feedback are valuable to us.